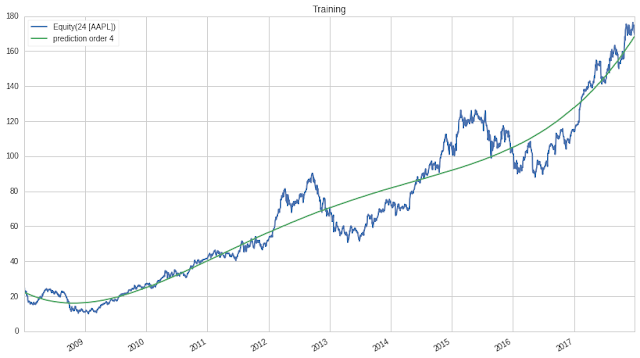

#using the polynomial function to predict next year's stock performance

start = '2008-01-01'

end = '2018-01-01'

price_train = get_pricing('AAPL', fields='price', start_date=start, end_date=end)

start = '2008-01-01'

end = '2019-12-01'

price_test = get_pricing('AAPL', fields='price', start_date=start, end_date=end)

import numpy as np

import matplotlib.pyplot as plt

import pandas as pd

polyfit_order = 2

def polyfit_training(N=polyfit_order):

x = np.arange(len(price_train))

c = np.polyfit(x, price_train.values, N)

y = np.zeros(len(price_train))

for i in range(0, N+1):

y += np.power(x,N-i)*c[i]

f = pd.Series(y, index=price_train.index, name='prediction order {} '.format(N))

pd.concat([price_train, f], axis=1).plot()

plt.title('Training')

return c

def polyfit_prediction(N=polyfit_order):

c = polyfit_training(N)

x = np.arange(len(price_test))

y = np.zeros(len(price_test))

for i in range(0, N+1):

y += np.power(x,N-i)*c[i]

f = pd.Series(y, index=price_test.index, name='prediction order {} '.format(N))

return f

pd.concat([price_test, polyfit_prediction(4)], axis=1).plot()

plt.title('Prediction')

given apple 10 years performance(2008-2018), generate 4th order polynomial

using the polynomial to predict apple performance in 2019

prediction is higher than real price

pd.concat([price_test, polyfit_prediction(3)], axis=1).plot()

train 3rd order ployfit

prediction is lower than real price

train 3rd order polyfit for Deutsche Bank

predicted performance is worse than real

train 2nd order polyfit for Deutsche Bank

performance is close to real

2nd order IBM

5th order IBM

3rd order Exxon mobile

5th order Exxon mobile

http://chuanshuoge2.blogspot.com/2019/12/quotopian-lecture-polyfit.html

No comments:

Post a Comment